(1) Riding the Crest: $ARES and the Surge of Alternative Asset Managers

Ares Management - The Bespoke Leader in Tailored Private Credit Solutions

In the first part of this article, we will explore the alternative asset management industry, using Ares Management as a case study. We'll delve into the historical growth of the sector, examine how these companies generate their earnings, and discuss the future of the industry.

Ares Management Corporation (NYSE: ARES), a key figure in the international alternative investment market, offers an extensive array of both primary and secondary investment choices. Specialising in a variety of asset classes such as credit, private equity, real estate, and infrastructure, they are dedicated to providing flexible capital solutions that aid businesses, thereby creating value for shareholders, fund investors, and employees. Leveraging the combined strengths of their expansive investment sectors, they are committed to delivering consistent and attractive returns on investment, irrespective of the prevailing economic conditions.

Ares Management was founded in 1997 by a veteran team of investment professionals. The co-founders included Antony Ressler, Michael Arougheti, David Kaplan, John H. Kissick, and Bennett Rosenthal.

Ares Management began its journey focusing on investments in leveraged loans, high yield bonds, private debt, private equity, and various other financial instruments. Over the years, Ares has impressively expanded its investment platform and expertise, both organically and through strategic acquisitions.

As a top-tier global alternative investment manager, Ares excels in creating synergies across different investment platforms, greatly benefiting its fund investors and shareholders.

Shareholders of ARES 0.00%↑ has benefited from 778.46% returns since the IPO on 05/02/2014, including the reinvestment of the distributed dividends. Equating to 25.5% CAGR to this day.

Ares Management raises $217 million in IPO

From its inception, Ares has consistently shown an ability to deliver attractive risk-adjusted returns across different market cycles. This performance has established them as one of the most rapidly growing and diversified alternative investment managers in the industry.

Alternative asset management companies earn money through several key methods:

Management Fees: This is a primary source of income for most alternative asset management companies. They charge a fee, typically a percentage of the assets under management (AUM) in a given fund, for managing the investments. This fee is usually annual and can range from 0.5% to 2% of the AUM, depending on the type of investments and the firm's strategy.

Performance Fees: In addition to the management fee, many alternative asset management firms also charge a performance fee. This fee is based on the profits generated by the investments. A common structure is the "2 and 20" model, where firms charge a 2% management fee and a 20% performance fee on any gains over a specified benchmark. The performance fee incentivises the firm to achieve higher returns for its clients.

Carried Interest: Particularly in private equity and venture capital, firms often earn carried interest. This is a share of the profits generated by the investment fund, typically around 20%, after returning the initial capital to investors and achieving a certain level of return (hurdle rate).

Transaction and Advisory Fees: Some alternative asset management firms also engage in advisory services, such as assisting in mergers and acquisitions, restructuring, or other financial advisory services. They earn fees for these services.

Product and Fund Structuring Fees: For creating and structuring new investment products or funds, firms may charge fees. These can include setup fees, legal fees, or other administrative expenses passed on to investors and/or clients.

Syndication Fees: In cases where the firm syndicates investments, or brings together multiple investors for a particular deal, they may charge a syndication fee.

Interest Income: Firms may earn interest on cash holdings or from certain types of debt investments.

The exact revenue model can vary depending on the specific focus of the alternative asset management firm, whether it's focused on hedge funds, private equity, real estate, commodities, or other alternative investments. The risk and return profile, as well as the liquidity of the investments, also influence how these firms structure their fees, revenue streams and balance sheets (asset-light or asset-heavy).

The business models of alternative asset managers typically bifurcates into two main types: asset-light, as exemplified by Ares Management, and asset-heavy.

This is an insightful research article by Ernst & Young LLP, which offers an in-depth analysis of the key differences, advantages, and drawbacks associated with the two business models: How asset-light strategies and models can boost business growth

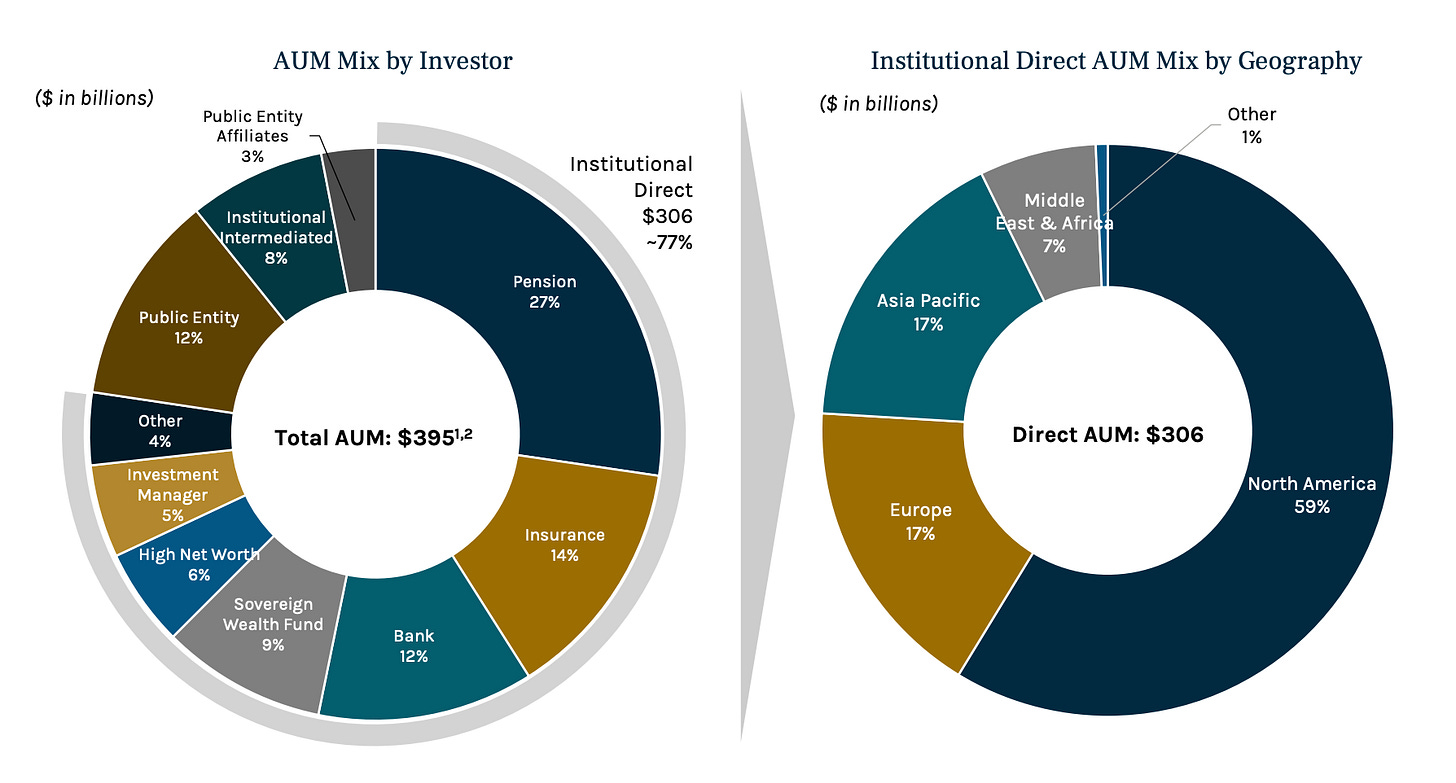

While the company engages in all areas of the alternative asset management space, similar to its competitors, its primary emphasis is on private credit in its various forms. This includes Direct Lending, Alternative Credit, Leveraged Loans, Syndicated Loans, High Yield Bonds, and the structuring and trading of Collateralized Loan Obligations (CLOs). Notably, this sector accounts for over half—56%, to be precise—of the company's AUM and, consequently, its Management Fees.

As the company’s CEO, Michael Arougheti, like to say in the conference calls, investor day presentations and general meetings:

“Ares Has a Credit DNA!”

$ARES faces competition in the asset-light arena from major players like Blackstone ($BX), The Carlyle Group ($CG), and Brookfield Asset Management ($BAM), as well as from smaller, niche firms like Blue Owl Capital ($OWL), TPG ($TPG), P10 ($PX), Patria Investments($PAX, which operates only in Latin America).

In the asset-heavy segment, significant competitors include Apollo Global Management ($APO), Kohlberg Kravis Roberts & Co ($KKR), and Brookfield Corporation ($BN, which holds a 75% stake in BAM 0.00%↑), along with Partners Group Holding AG ($PGHN.SW), which is based and listed in Switzerland.

In an asset-light business model, there's minimal ownership of assets, characterised by a relatively small amount of fixed assets on the balance sheet. This typically involves investing modest amounts of the company's own capital alongside fund investors.

Conversely, an asset-heavy business model adopts the opposite approach. It involves investing considerably larger portions of the company's own capital into the managed funds.

In both the asset-light and asset-heavy models, investments in their own managed funds usually occur through the use of retained, undistributed earnings. This is often coupled with the allocation of earned carried interest and accrued performance (incentive) fees.

Tailwinds in the Alternative Asset Management Industry

The refer to factors and trends that drive growth and success in this sector. Some of the key tailwinds include:

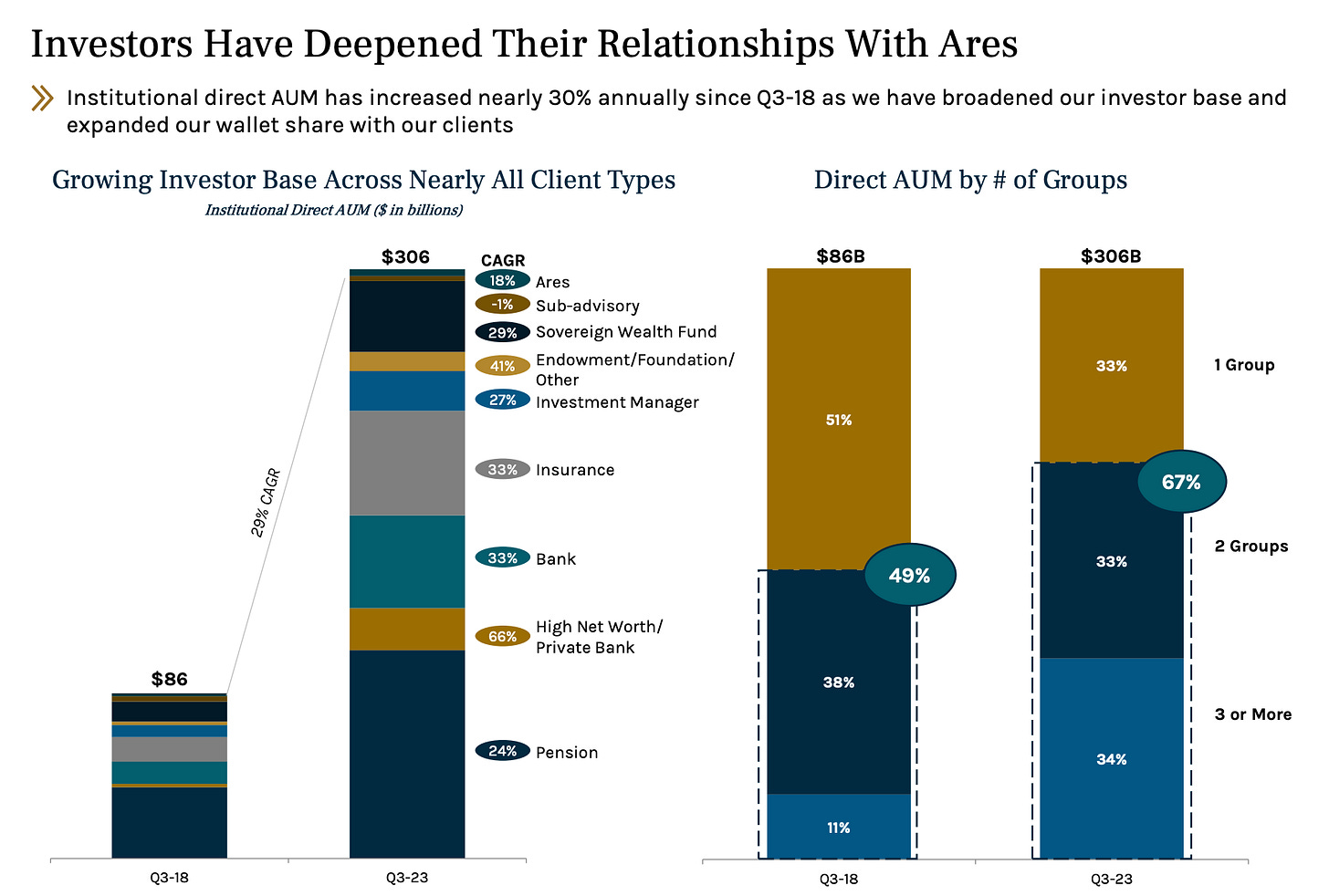

Increased Institutional Investment: Many institutional investors, such as pension funds, endowments, and insurance companies, are increasingly allocating a larger portion of their portfolios to alternative assets. This shift is driven by the search for higher returns and diversification benefits compared to traditional asset classes like stocks and bonds.

Wealth Accumulation and High-Net-Worth Individuals (HNWIs): The growth in global wealth, especially among HNWIs, has led to increased demand for alternative investments. These individuals often seek bespoke investment opportunities and higher returns, which alternative asset managers, as is the case with Ares Wealth Solutions, are well-positioned to provide.

Diversification Benefits: Alternative assets are often less correlated with traditional markets, making them attractive for portfolio diversification. This appeal has grown in light of increased market volatility and uncertainty in global financial markets.

Innovative Investment Products: Alternative asset managers are continuously developing innovative products and strategies to attract investors. This includes thematic investments, impact investing, and ESG focused funds, which are gaining popularity among a broad range of investors.

Regulatory Changes: In some regions, regulatory changes have made it easier for individual investors to access alternative investments, previously the domain of institutional investors and HNWIs. These changes are broadening the investor base for alternative assets.

Global Economic Growth: As economies grow, particularly in emerging markets, there are more opportunities for alternative investments.

Search for Yield: With traditional assets often providing low yields, especially in a low-rate environment, investors are increasingly turning to alternative assets for potentially higher returns.

Increasing Demand for Private Credit: There's a growing interest in private debt as an alternative asset class, driven by the higher yields and potential for diversification it offers compared to traditional fixed-income investments.

Heightened Regulations for Traditional Banks: The ever-increasing regulatory demands on banks, particularly post-GFC, have led them to pull back from significant activities. This retreat has created an opportunity for alternative asset managers to step in and fill the void.

We consider the ninth point to be the most significant driver in the increasing global demand for private credit, which Ares is a major beneficiary of.

These tailwinds, combined with the evolving financial landscape, suggest a favourable outlook for the alternative asset management industry, although they also come with their own set of risks and challenges.

With just shy of $400B of AUM, ARES 0.00%↑ stands out in the realm of the publicly traded major asset managers. While the broader industry grapples with the highest interest rates seen in two decades, Ares has reported continued net inflows of capital and robust fee income in its latest quarterly results.

The company is strategically poised to leverage discounted private credit opportunities in the forthcoming phase of the economic cycle. The substantial pool of capital that Ares has ready for investment, $104.6B as of 09/30/2023, is a harbinger of significant potential for growth. We view $ARES as a frontrunner in its field and anticipate its shares to experience further upward movement in the long-term.

The stable and diversified management fee-driven business model of alternative asset managers is a significant aspect of their overall strategy. Here's how this model contributes to the stability and success of these firms in the long-term:

Steady Revenue Stream: Management fees, a percentage of AUM, provide a steady, predictable source of income. This stability is particularly valuable in the often volatile world of finance, as it offers a buffer during market downturns or when performance fees may be lower.

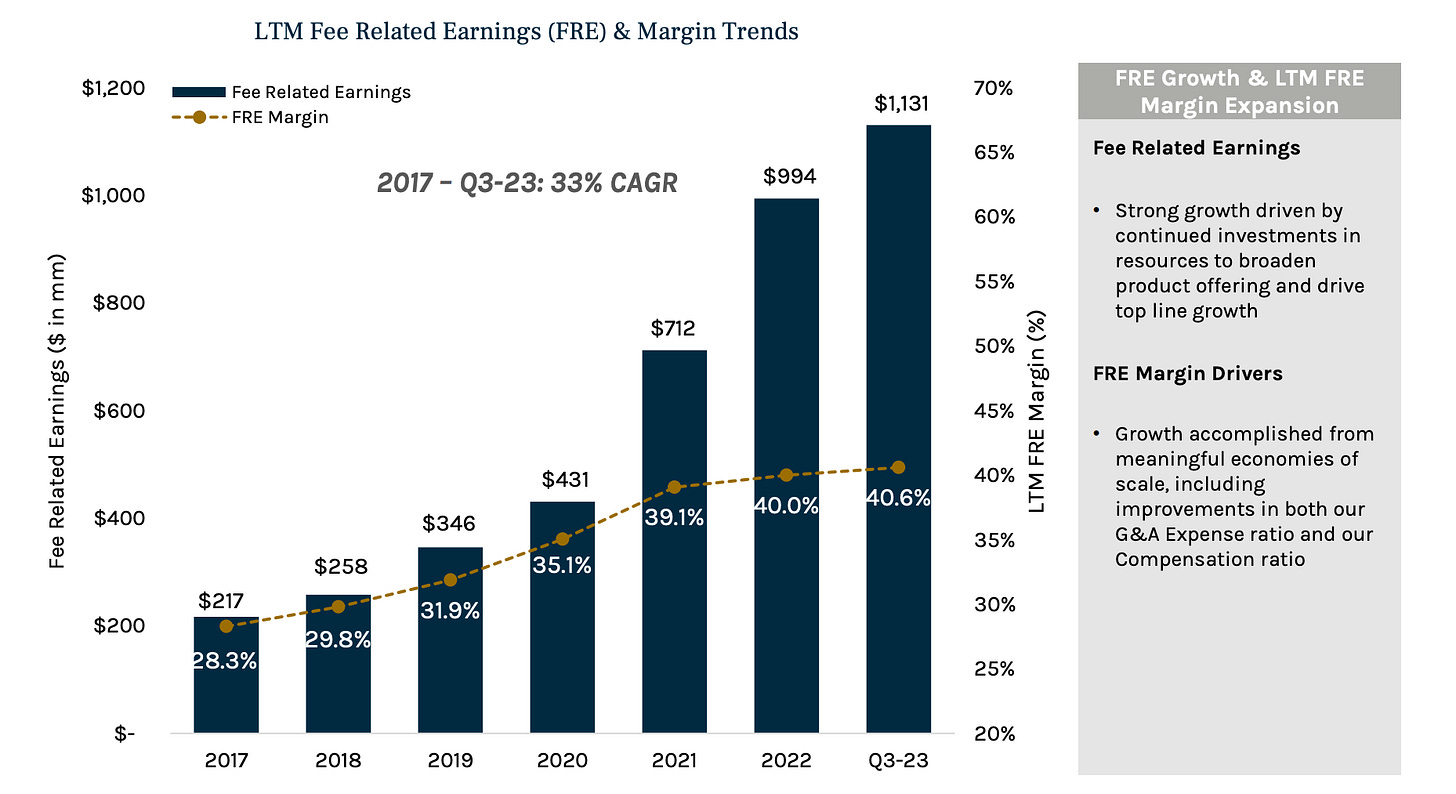

Scalability: As the AUM increases, whether through market appreciation or new capital inflows, management fees grow correspondingly. This scalability is advantageous as it can lead to higher revenue without a proportionate increase in operational costs - margin expansion.

Diversification Across Asset Classes: Alternative asset managers often diversify their offerings across various asset classes like real estate, private equity, hedge funds, commodities, and infrastructure. This diversification not only attracts a broader range of investors but also stabilises fee income, as different asset classes may perform well at different times.

Alignment with Long-Term Investment Horizons: Many alternative investments, particularly in areas like private equity and real estate, are characterised by longer investment horizons. This aligns with the management fee model, ensuring a longer-term, stable fee stream.

Attracting Institutional Investors: The predictable nature of management fees is attractive to institutional investors, such as pension funds and endowments, who prefer stable and predictable investment costs for budgeting and financial planning purposes.

Reducing Dependence on Performance Fees: While performance fees (like those in the "2 and 20" model) can be lucrative, they are also more variable and dependent on market conditions. A strong focus on management fees can reduce reliance on these more unpredictable income sources

Global Reach and Expansion: Alternative asset managers with a diversified and management fee-driven model can expand globally, tapping into different markets and investor bases, further diversifying their revenue streams.

Robust Infrastructure: Stable management fee income allows firms to invest in robust operational and technological infrastructure, enhancing their investment capabilities and client services.

Flexibility in Investment Strategy: A stable fee base provides alternative asset managers with the flexibility to explore new investment strategies and take longer-term positions that may not provide immediate returns but have the potential for high future payoffs.

Overall, the stable and diversified management fee-driven business model is a cornerstone of the alternative asset management industry, helping firms navigate the complexities of the financial markets while providing a reliable revenue stream. However, it's important to balance this with performance-based incentives to ensure alignment with client interests and optimal investment outcomes.

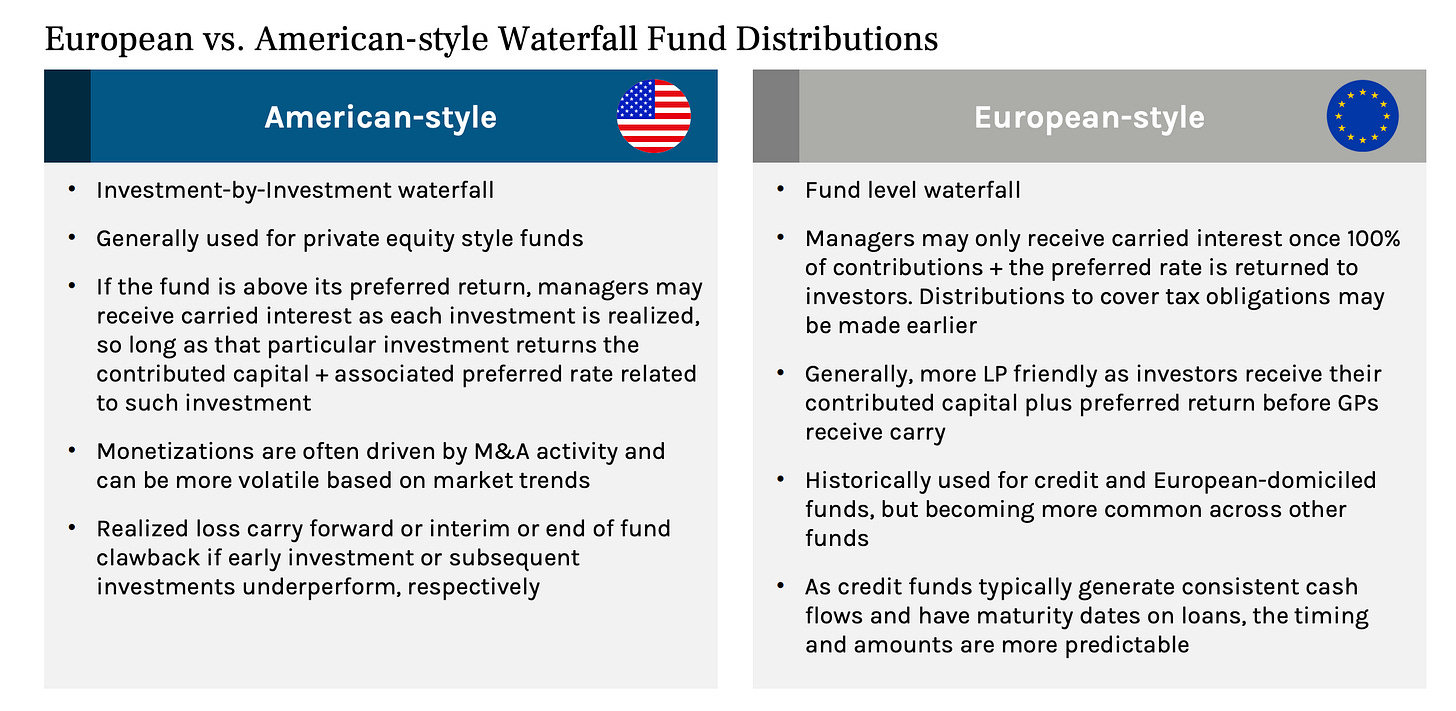

European vs. American-style Waterfall Fund Distributions

Key Factor Driving Future Margin Growth

Ares Management, with a significant emphasis on credit-oriented funds, has seen substantial growth in its European-style waterfall funds, known for distributing performance income after fully returning contributed capital with a preferred rate to investors. These funds experienced a marked increase during 2017-2018, and as of the end of 2022, they account for approximately $53 billion in Ares’ Incentive Generating Assets Under Management (IGAUM) and about $100 billion in Incentive Eligible Assets Under Management (IEAUM).

Predominantly found in credit strategies, these European-style waterfall funds also span a variety of other private debt, real assets, and equity funds across different groups at Ares. Notably, around 90% of Ares’ European-style AUM is actively generating incentives. However, it's important to note that Ares’ Realized Income doesn't yet reflect the potential future earnings from the continuous expansion of these European-style waterfall funds.

Although a detailed exploration of European-style funds is a subject for another of our articles, we recommend in the meantime that you delve into the outstanding presentation on this topic crafted by the company itself:

European-style Waterfall Funds and Performance Income Teach-in

Dividends

Ares Management's business model revolves around distributing the bulk of its stable and relatively predictable Fee Related Earnings as dividends, often surpassing 80-90%. Meanwhile, for balance sheet co-investments, the company retains mainly the Performance Related Fees, which are known to fluctuate and be unevenly dispersed over the economic cycle.

Consequently, this approach renders the dividend distributions from Ares Management both safe and reliable. Moreover, these dividends have shown phenomenal growth rates, almost mirroring the expansion seen in the company's AUM and FRE.

Since its IPO, Ares Management has experienced a CAGR in dividends around 15%. Remarkably, in the last three years, following the onset of the pandemic, the dividend CAGR has surged to an impressive 25%.

Accretive Capital Allocation: M&A Activity

Known as a premier global alternative investment manager renowned for creating cross-platform synergies for investors, Ares Management has a track record of channeling its "excess" capital—funds not distributed as dividends—into value-enhancing acquisitions. This typically involves either complete buyouts or acquiring majority ownership stakes.

This strategy often targets companies operating in geographic locations where Ares has little to no presence, or those offering investment products that would complement and enhance Ares' existing portfolio of opportunities.

Since its inception in 1997, Ares has notably expanded its investment platform and capabilities, both organically and via carefully considered strategic acquisitions. Let's now delve into some key highlights of these acquisitions:

2010: Ares' managed perpetual vehicle, a Business Development Company (BDC), acquires Allied Capital, creating one of the largest BDCs in the industry.

2011: The addition of Indicus Advisors and Wrightwood to their team bolsters their expertise in alternative credit and real estate debt investing.

2013: The acquisition of Area Property Partners, L.P., a notable firm in real estate private equity.

2015: Ares takes over Energy Investors Funds (EIF), a prominent U.S. asset manager specializing in infrastructure and power sectors.

2017: Ares Capital (ARCC) successfully completes the acquisition of American Capital, Ltd., strengthening their position in U.S. middle market direct lending.

2020: Ares expands into Asia-Pacific by acquiring SSG Capital Holdings, a leading credit-focused alternative investment manager in the region.

2021: With strategic acquisitions of Landmark Partners and Black Creek Group, Ares launches its Secondaries Group, enhances its industrial real estate investment capabilities, and introduces Ares Wealth Management Solutions.

2022: Ares enhances its platform with the strategic acquisition of AMP Infrastructure Debt, adding infrastructure debt investment expertise.

02/28/2023: Ares Management forms a strategic partnership with BlueCove, acquiring a minority equity stake.

03/22/2023: A joint venture between Ares Management and Mubadala is announced, focusing on global credit secondaries opportunities.

07/17/2023: The acquisition of Crescent Point Capital, a leading Asia-focused private equity platform, augments Ares' investment capabilities in Asia.

10/10/2023: A strategic partnership and investment with Vinci Partners is announced by Ares Management, aiming to boost the growth of private markets offerings in Latin America.

We are inclined to think that the rapid expansion of Ares Management, its global platform, and the resulting synergies are only beginning to unfold. It leads us to conclude that the partners at the company are deeply committed to building a truly superior alternative asset management firm.

Valuation

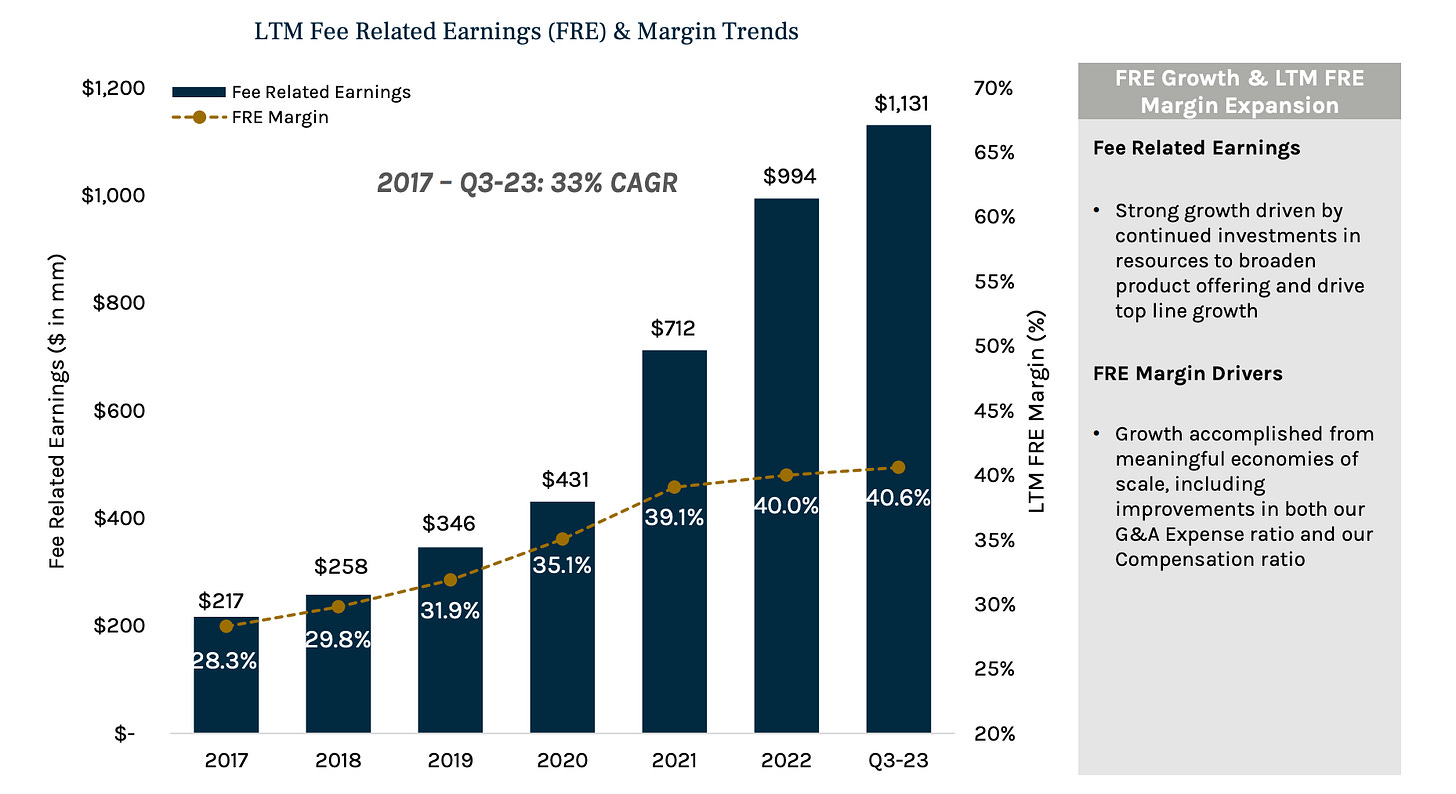

Asset-light alternative managers are typically valued based on a multiple of their annual Fee Related Earnings (FRE), as these represent the most consistent and predictable form of earnings. In many instances, Performance Fees and/or Carried Interest are excluded from valuation considerations due to their irregular distribution and the lack of certainty in being earned.

As of November 24, 2023, the company has a total Market Capitalisation of $32.9 billion. With the FRE for the Last Twelve Months amounting to $1.13 billion, this results in a 'modified' Price-to-Earnings (P/E) ratio of 29.12

The ‘modified’ Free Cash Flow (FCF) yield being 3.43%

As of now, the company's dividend yield stands at 2.83%, equating to $0.77 per quarter. The next dividend distribution is anticipated on 12/29/2023 with ex-date on 12/14/2023, with an expected increase in the dividend to be announced alongside the release of the Q4-2023 earnings and the Annual Report for 2023.

In light of this information, it's also important to highlight the anticipated double-digit growth in allocations towards Alternative Investments, which we believe Ares’ AUM and hence FRE would also experience, particularly in the individual investor sector, expressed by the Ares Wealth Management Solutions This trend underscores the expanding interest and investment in this area.

Moreover, we believe that companies with a proven track record, deep institutional investor relationships, and scaled platforms—traits that align with Ares Management's history of delivering phenomenal fund returns—will be well-positioned to capture an increasingly larger share of the expected growth in AUM. This trend favours established firms like Ares, which have demonstrated consistent performance and reliability in the field.

Having highlighted these aspects, we believe that individuals interested in becoming shareholders can now make a more informed decision about whether they view the company as undervalued, fairly valued, or overvalued by the public market, and act accordingly. It's important to remember that everyone's financial situation, expectations, and investment time horizons vary, leading to different investment decisions based on their unique circumstances and perspectives.

Business Entities Structure

Like many other alternative asset managers, Ares Management is no different in having a seemingly complex business structure initially. This includes various classes of common stock and non-listed units.

To put it simply, the founding partners of Ares Management maintain their ownership interest in a distinct, non-listed holding entity, Ares Owners Holdings L.P. They only convert their Ares Operating Group (AOG) units into public shares if they intend to sell securities. As of September 30, 2023, the founders hold 38.61% of the Ownership Interest in Ares Management, leaving 61.39% attributed to the publicly listed shares.

This intricate business structuring is typically employed for optimising tax benefits, in conjunction with the exclusive holding of Class C voting shares and Class B super-voting shares, possesing 4 votes.

From examining the list of shareholders, it is noticeable that in addition to the non-listed units, the founding partners and key employees of Ares Management also own a significant portion of the public float. Specifically, Ares Partners Holdco LLC possesses 7.44%, which is valued at $1.50 billion.

In conclusion, this setup indicates a robust alignment between management interests and the company, with insider ownership being a significant and active component.

In the second part of this article, we will undertake a detailed examination of Ares Management's balance sheet, focusing on their investments in their own funds, stakes in public companies, and the debt they issue. Additionally, we will review the historical performance of their funds to provide a comprehensive understanding of their financial strategies and outcomes. And finally will discuss all the risks associated with the alternative asset management industry.

Sources:

Ares Management Corporation Investor Resources

How asset-light strategies and models can boost business growth

Used for visualisation purposes:

Disclosure: The author owns shares in the company being discussed. However, there are concerns raised about the company's current high valuation.

Looking forward to hearing your thoughts, perspectives, and critiques on this matter. Your input is invaluable and will greatly contribute to a more constructive discussion.

Stay safe and be healthy!