European vs. American-style Waterfall Funds

Examining the Main Differences, Pros and Cons of Both Structures ft. Ares Management

The main difference between European and American style waterfall structures in private equity/private credit funds lies in the method and sequence of distributing returns to limited partners (LPs) and the general partner (GP). These structures define how profits, if any, are split after investments are liquidated.

European Style Waterfall (Whole Fund Model)

Sequential Distribution: In the European model, distributions are made on a fund-wide basis. This means that returns from the entire fund must first be used to return all the contributed capital to the LPs.

Priority to LPs: The LPs receive their initial capital contributions before the GP starts receiving its carried interest. Only after the LPs have received 100% of their initial capital does the GP begin to receive its share of the profits.

Hurdle Rate: Often, the GP will only start to receive carried interest after achieving a specified rate of return or hurdle rate, which further protects LP interests.

Risk Mitigation for LPs: This structure is seen as more LP-friendly as it mitigates the risk of the GP receiving a disproportionate share of early profits from successful investments while other investments may not perform as well.

American Style Waterfall (Deal-by-Deal Model)

Deal-by-Deal Distribution: The American model allows for distributions to be made on a deal-by-deal basis. The GP can receive its carried interest after each successful exit, without having to wait for the entire fund to be liquidated or for all investments to be exited.

Faster GP Compensation: This model can lead to the GP receiving carried interest more quickly, as they do not have to wait for the return of all contributed capital to the LPs.

Hurdle Rate May Apply: Some American style waterfalls also include a hurdle rate, but it is applied on a deal-by-deal basis.

Higher Risk for LPs: This structure can be riskier for LPs because the GP might receive carried interest from early successful investments, even if subsequent investments perform poorly. This can lead to a situation where the GP has received a significant share of profits, but the LPs have not yet seen a return on their overall fund investment.

Building on our previous article, we will now explore how the presence of European-style Waterfall funds, alongside American-style ones, impacts the financials of Ares Management. This analysis aims to provide a deeper understanding of the influence these fund structures have on the company's overall financial performance.

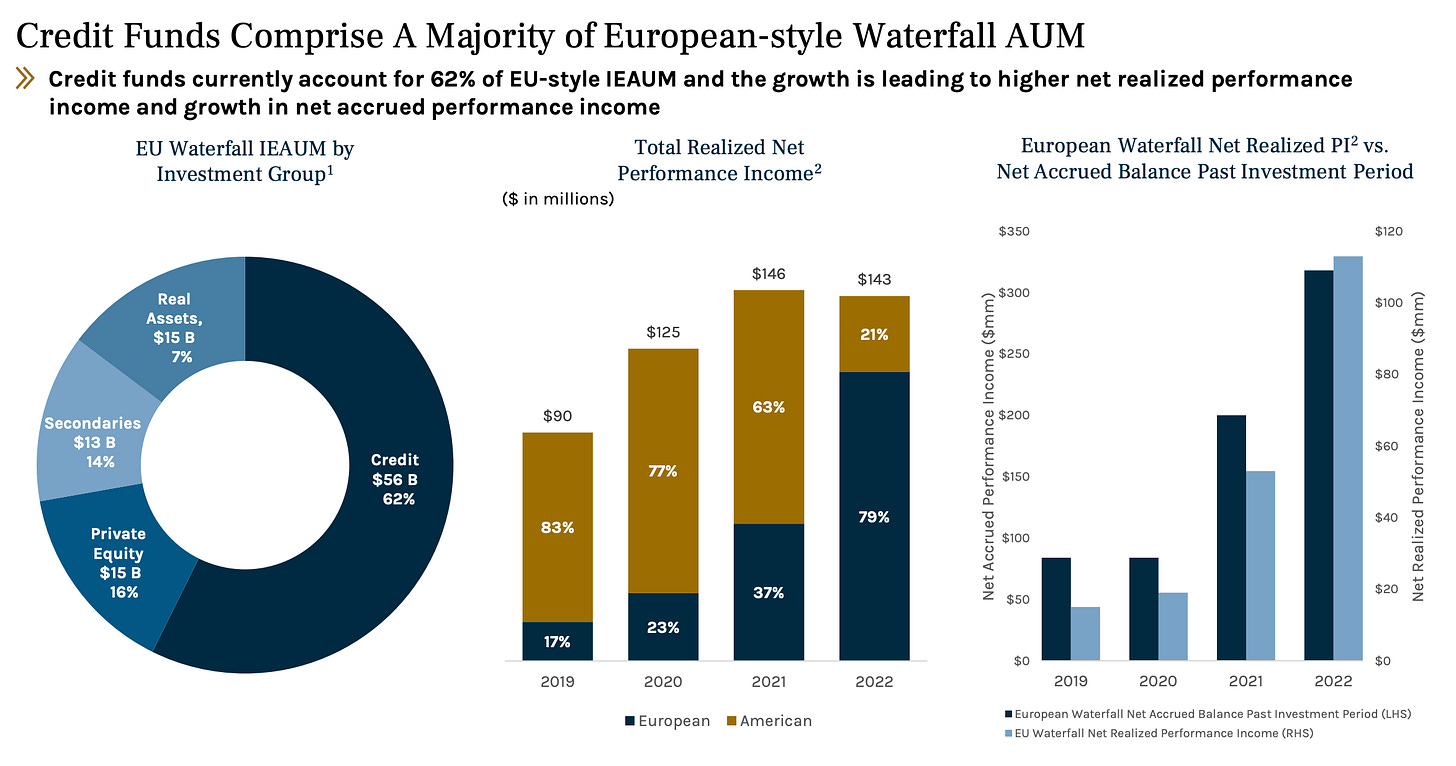

Ares Management, known for its substantial focus on credit-oriented funds, has a notable and increasing volume of European-style waterfall funds. These "EU-style" or "European-style" funds are structured to distribute performance income, but only after all contributed capital has been returned to investors along with a preferred rate on that capital, as we have discussed above.

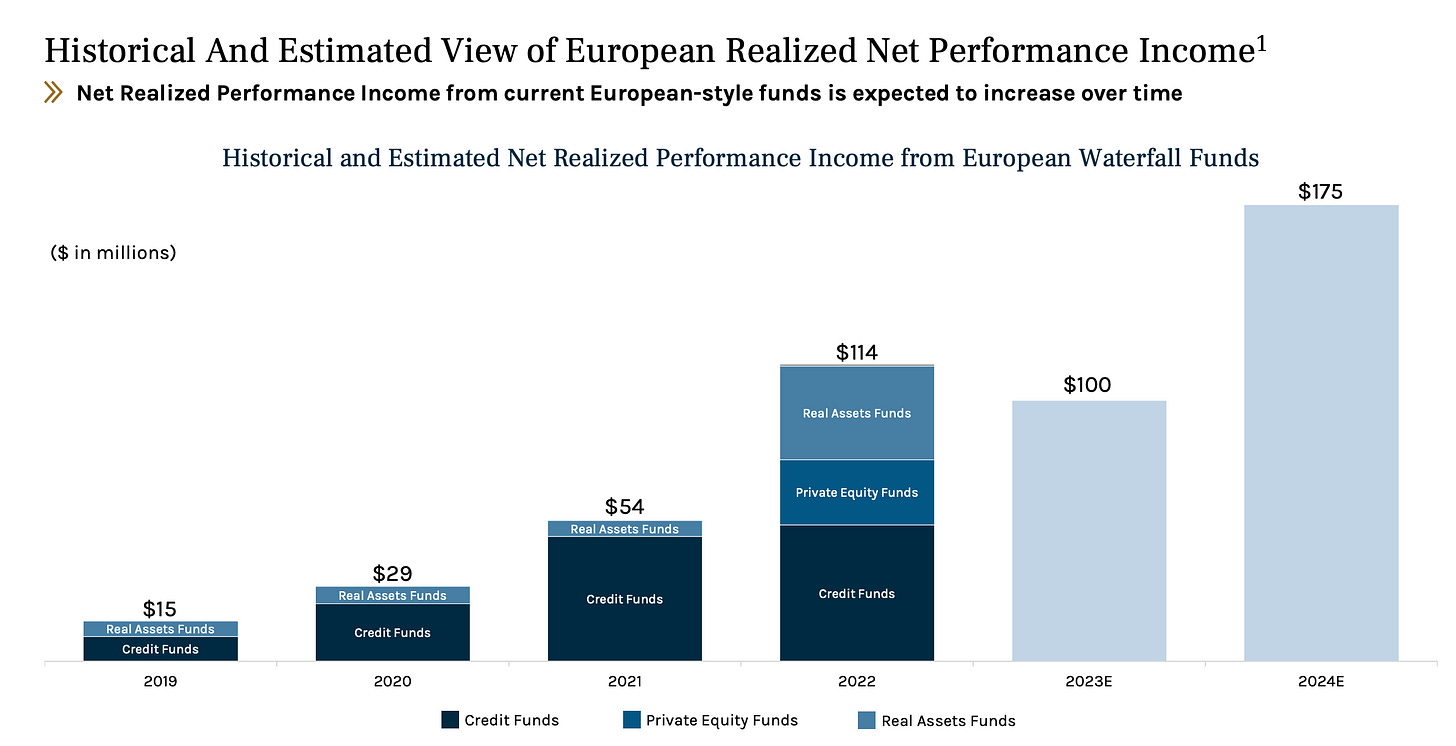

In the years 2017 to 2018, Ares Management experienced a significant rise in their European-style waterfall funds. As of the end of 2022, these funds represent approximately $53 billion in Ares' Incentive Generating Assets Under Management (IGAUM) and about $100 billion in Incentive Eligible Assets Under Management (IEAUM), marking a substantial portion of the company's asset portfolio.

The clear visibility and understanding of the potential growth in Ares’ European-style funds, as well as their prospects for future realised net performance income, represent, in our opinion, the largest opportunity for total margin expansion. This potential is particularly evident as these funds enter their harvesting phase, where the real financial benefits are expected to materialise.

Ares' Realised Income, as recorded in their accounting, does not account for the future earnings potential stemming from the growth of their European-style waterfall funds. However, as indicated by the data presented earlier, these funds hold significant Net Accrued Performance Income, suggesting a substantial future financial impact that is not yet reflected in the current realised income figures

The majority of Ares' European-style waterfall funds are invested in credit strategies. However, their portfolio is diverse, including other private debt, real assets, and equity funds across various groups within the company. Notably, about 90% of Ares’ invested AUM in these European-style funds are currently generating incentive fees.

In the next article, we will undertake a detailed examination of Ares Management's balance sheet, focusing on their investments in their own funds, stakes in public companies, and the debt they issue. Additionally, we will review the historical performance of their funds to provide a comprehensive understanding of their financial strategies and outcomes. And finally will discuss all the risks associated with the alternative asset management industry.

Disclosure: The author owns shares in the company being discussed. However, there are concerns raised about the company's current high valuation.

Looking forward to hearing your thoughts, perspectives, and critiques on this matter. Your input is invaluable and will greatly contribute to a more constructive discussion.

Stay safe and be healthy!